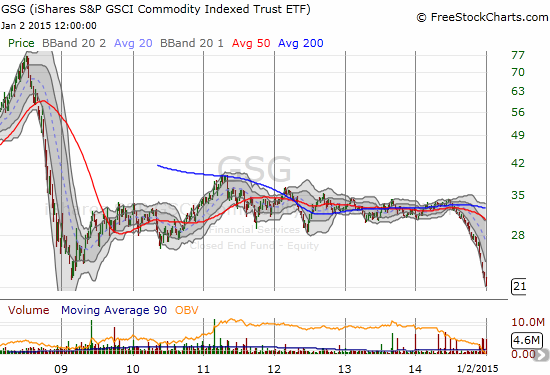

The fund gains its exposure through commodity-linked investments such as futures contracts, options on futures and swaps. In January of each year, the index selects 14 commodities from the broad groups based on global production levels and the price of the commodity.

#ISHARE COMMODITY FREE#

The firm's 50 day moving average is $27.43 and its two-hundred day moving average is $32.50. The stock has a market capitalization of $1.05 billion, a price-to-earnings ratio of -12.52 and a beta of 0.54. iShares GSCI Commodity Dynamic Roll Strategy ETF has a 52 week low of $25.28 and a 52 week high of $46.28. 21,592 shares of the stock traded hands, compared to its average volume of 866,902. NASDAQ:COMT traded down $0.04 during mid-day trading on Wednesday, hitting $25.88. iShares GSCI Commodity Dynamic Roll Strategy ETF Stock Down 0.2 % 1.80% of the stock is currently owned by hedge funds and other institutional investors. Finally, Absolute Capital Management LLC purchased a new position in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF during the 3rd quarter worth about $71,000. Nelson Van Denburg & Campbell Wealth Management Group LLC now owns 1,379 shares of the company's stock worth $49,000 after acquiring an additional 1,252 shares during the last quarter. Nelson Van Denburg & Campbell Wealth Management Group LLC lifted its holdings in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF by 985.8% in the 3rd quarter. GoalVest Advisory LLC now owns 1,680 shares of the company's stock valued at $47,000 after acquiring an additional 1,678 shares during the period. GoalVest Advisory LLC raised its stake in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF by 83,900.0% in the fourth quarter. now owns 898 shares of the company's stock valued at $36,000 after acquiring an additional 549 shares during the period. raised its stake in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF by 157.3% in the first quarter. Sargent Bickham Lagudis LLC bought a new position in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF during the 3rd quarter valued at approximately $25,000. Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. owned about 0.14% of iShares GSCI Commodity Dynamic Roll Strategy ETF worth $3,043,000 as of its most recent SEC filing. The fund owned 85,200 shares of the company's stock after selling 3,940 shares during the quarter. reduced its stake in shares of iShares GSCI Commodity Dynamic Roll Strategy ETF ( NASDAQ:COMT - Get Rating) by 4.4% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). 3 Reasons to Pick First Citizens Instead of First Republic Bank.3 Reasons Why Apple’s 30% Rally Has Legs.Hypercharge Networks: Up Triple Digits, But What’s The Big Deal?.2 Beautiful Investments In A Growing Industry.What Factors Will Drive S&P 500 Performance This Year?.Walmart Makes Moves for Efficiency with Robots to Spur Sales.FedEx Takes Flight Analysts See More Gains Ahead.3 Low-Cost Stock ETFs That Are Crushing It This Year.The WD-40 Company Bottoms With Reversal In Sight.First Republic Bank Is A Speculative Play, Here’s Why.

#ISHARE COMMODITY DRIVER#

Costco Sales Disappoint, Markets Are Missing This Upside Driver.Investing in Cybersecurity Stocks: The AI Advantage.Tesla Stock: Reasons to Worry or Reasons to Buy.Finding High-Yield Value Stocks: Guide For Investors.The Trader's Guide to Equities Research.

0 kommentar(er)

0 kommentar(er)